U.S. Defense Spending During and After the Pandemic

“I’ve ordered plans to begin for the massive rebuilding of the United States military. Had great support from the Senate. I’ve had great support from Congress, generally. We’ve pursued this rebuilding in the hopes that we will never have to use this military.”

“Don’t tell me what you value, show me your budget, and I’ll tell you what you value.”

– Former Vice President Joe Biden

How will the economic and political impact of COVID-19 affect future U.S. defense spending? Are the assumptions that underpinned budget forecasts before the crisis still relevant? And what does the history of American military spending tell us about the future trajectory of the defense budget?

Heading into 2020, the prospects for U.S. defense spending seemed to be fairly clear. It was assumed that defense toplines would be constrained by higher deficits and debt servicing for the foreseeable future. While many of those assumptions remain true, debates over modest increases in the defense topline have been rendered a sideshow relative to the massive disruptions and potentially epoch-changing events of this year.

COVID-19 could have major implications for defense spending. Given the scale of the recession caused by the pandemic, and the debt accrued by the government in order to stimulate the economy, future cuts to the defense budget may be inevitable. However, the historical evidence suggests that recessions do not necessarily lead to decreased funding for the Pentagon. Indeed, given rising international tensions, military spending over the next few years might actually level off or even increase. Analysts will need to carefully watch the political and geopolitical events of the next few months as they make spending forecasts, and should avoid assuming that the economic crisis and inflated deficits will lead to cuts in the defense budget.

The Scale of Disruption

The first half of 2020 has brought with it unprecedented disruption. First, the COVID-19 pandemic has swept across the globe, killing hundreds of thousands of people and imposing economic costs unseen since the Great Depression. In response, the U.S. government spent trillions of dollars stabilizing the economy, resulting in record budget deficits. At the same time, China’s increasingly assertive diplomatic posture has contributed to disputes with the United States, the United Kingdom, Italy, India, Bhutan, and Australia. Its decision to subject Hong Kong to the draconian legal structure of the mainland has only further served to drive a wedge between the Chinese Communist Party and the international community. Internally, the United States has been racked by protests and unrest following the killing of George Floyd by Minneapolis police officers.

Whatever confidence may have existed in the future direction of the U.S. defense budget has been deeply eroded. In order to make sense of the path for defense spending, it is useful to put recent trends in a broader historical context.

The Effect of Economic Growth on U.S. Defense Spending

The conventional wisdom in defense budget forecasting is that economic downturns trigger a decline in defense spending. However, the historical evidence doesn’t seem to support this assumption. The line graph in the chart below represents constant “total obligation authority,” which is the amount of money actually spent by the Department of Defense (Table 6-1 in the Fiscal Year 2021 Green Book) while the vertical bars represent years where there were recessions (drawn from the National Bureau of Economic Research). A quick review of the graph demonstrates that some recessions have presaged declines in U.S. defense spending while others have preceded increases.

Figure 1: U.S. Defense Spending and Economic Recessions

Source: Chart generated by the author. Data from the National Bureau of Economic Research and Office of the Under Secretary of Defense (Controller).

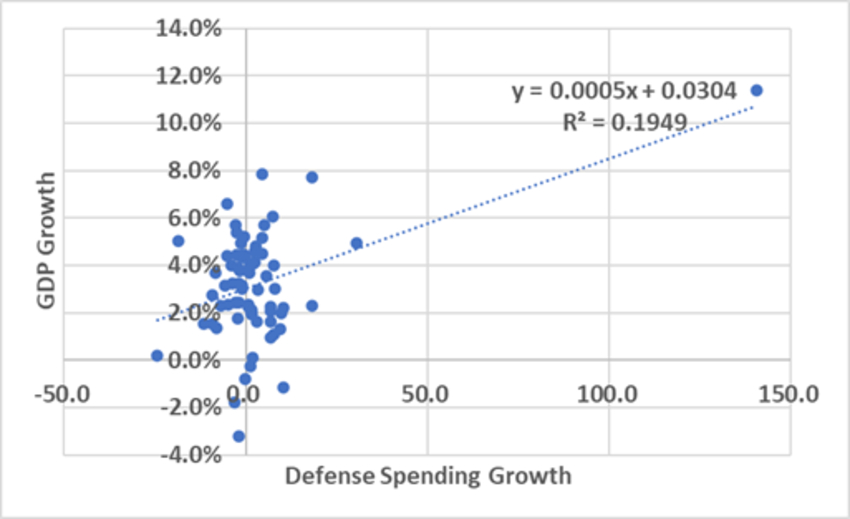

Similarly, a regression of real GDP growth and defense spending growth from 1948 to 2019 shows that there is almost no relationship between the two figures. In measuring how closely two variables are related, a regression calculation results in something called an “r-squared” value, which is what percent of the change in an output variable depends on an input. If you compare real GDP growth and defense spending growth for this period, the r-squared is .1949, which is fairly low. The scatter plot below suggests that there is a relationship between the two but that the connection is not particularly strong. Simply put, a reduction in defense spending following this downturn is certainly possible, but it is not foreordained.

Figure 2: U.S. GDP Growth and Defense Spending

Source: Chart generated by the author. Data from Office of Management and Budget.

Without the ability to draw a clear conclusion on the relationship between economic growth and defense spending, analysts will need to resort to more qualitative analysis to think through how defense spending may shift.

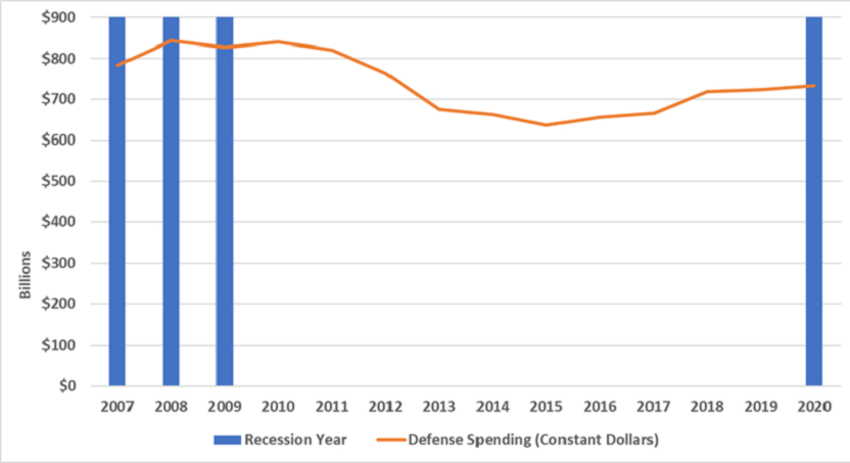

Precedent for a Downturn in Defense Spending

Defense spending could fall as deficits rise and political gridlock leads to across-the-board budget reductions. The 2008 economic crisis and subsequent implementation of the Budget Control Act provide a recent example of how such a reduction could take place. Following the 2008 recession, consecutive elections (2008 and 2010) produced a divided and highly partisan government. Internationally, threat levels to the United States remained relatively low. The Obama administration was able to reduce troop levels in Iraq, ties with Russia were fraught but hadn’t ruptured like they did after the 2014 invasion of Ukraine, and U.S.-Chinese relations were tense but relatively stable. The political focus in Washington shifted to austerity. Defense cuts between 2010 and 2015 represent a rough proxy for what might be expected as the United States’ debt burden rises — defense budget toplines in this period dropped from $839 billion in 2010 to $636 billion in 2015 in constant dollars.

While defense spending generally has bipartisan support, both for national security and more parochial reasons, that consensus has begun to fray. In the next few years, it is fairly easy to imagine a scenario in which military spending takes a hit. For example, a future Biden administration facing a Republican House of Representatives or Senate would almost certainly face rising calls for austerity measures in response to growing deficits, and defense spending might be cut in the process. While there has been broad support for increasing deficits under the Trump administration, it is likely that Republicans would oppose increased non-defense spending under a Biden presidency. If Democrats controlled both houses of Congress, they would almost certainly pass defense budget cuts (although much would depend on Republicans in the Senate and the fate of the filibuster). A Trump re-election would make major reductions unlikely. However, the future years defense program in the president’s proposed FY2021 budget only envisions military spending increasing in line with inflation, and budget hawks like the recently confirmed Office of Management and Budget head Russell Vought will likely push for further reductions.

Figure 3: U.S. Defense Spending Since the Great Recession

Source: Chart generated by the author. Data from the National Bureau of Economic Research and Office of the Under Secretary of Defense (Controller).

Could Defense Spending Increase After the Pandemic?

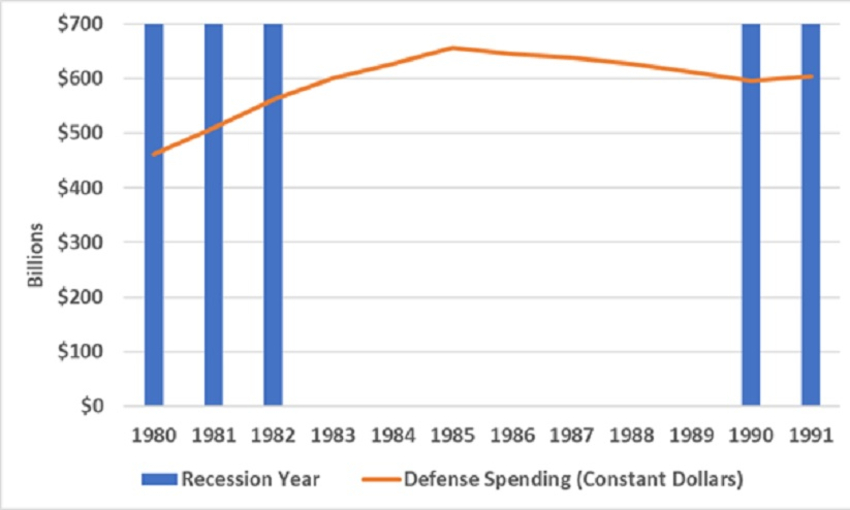

Defense spending could grow during and after the pandemic if policymakers and Congress grow more concerned about threats from China, Russia, Iran, or North Korea. In the early 1980s, the U.S. economy endured three years of recessions (one in 1980 and one that stretched from 1981 to 1982). In spite of this, the Carter administration increased defense spending in his last year in office in response to an assertive Soviet Union foreign policy. This increase was turbocharged by the Reagan administration through the mid-1980s during one of the most tense and dangerous periods of the Cold War. Simply put, policymakers seem willing to increase military spending, even during a recession, if perceived threats to U.S. national security are sufficiently severe.

The shape of the defense budget will be driven, for better or for worse, by America’s geopolitical environment, particularly its ties with other great powers. Given a growing consensus in Washington about taking a tougher line against Beijing, the possibility of increased defense investment is a distinct possibility.

Figure 4: U.S. Defense Spending in 1980s

Source: Chart generated by the author. Data from the National Bureau of Economic Research and Office of the Under Secretary of Defense (Controller).

Signposts to Watch For

It is too early to know whether political and economic factors will constrain defense spending, or if concern about America’s adversaries will lead to higher toplines. However, it is worth thinking through what events or developments might serve as signposts indicating how things may proceed.

A first key event will be the 2020 elections. Biden, the presumptive Democratic nominee, appears to be slightly favored over Trump, holding a lead nationally and in swing states as of mid-July. While defense spending can be influenced by other factors, the political configuration of Congress and the White House and the views of those institutions’ leadership is ultimately what dictates spending levels. Understanding the near- to mid-term political dynamics will go a long way towards understanding spending trends in the next several years.

A Biden administration would likely see Democrats keep control of the House and possibly win the Senate. Should Democrats control both chambers and the White House, they would likely seek to reduce topline defense growth, if not impose cuts on defense spending. There are clear divisions in the Democratic caucus between progressives and moderates that might mitigate against such cuts (defense spending remained high during the period of unified Democratic control in 2009 to 2010), but the party has shifted somewhat to the left in the interim. It is difficult imagine the broader caucus not pushing for reductions when, for instance, the chairman of House Armed Services Committee, Rep. Adam Smith, has talked about level or reduced spending. Republicans in this scenario would likely try to block Democratic moves in the Senate through the use of the filibuster. However, the party in the White House tends to struggle in midterms, so Democratic control of government might not extend past 2022. Should Democrats fail to take the Senate, it becomes much harder to see defense spending falling significantly, as Senate Republicans will almost certainly demand defense spending levels be treated similarly to non-defense spending.

A second Trump term would potentially see Republicans regain control of the House (the current Democratic House majority is largely made up of seats that went for Trump in 2016, but voted for a Democratic member of congress in 2018) and certainly hold the Senate. Such a configuration would bode well for near-term defense spending and likely have significant implications for relations with China. The hawkish positioning of the Trump administration, even if muddled by the inconsistent rhetoric of the president, would almost certainly accelerate existing tensions. Although a bipartisan consensus seems to have emerged on the Hill in favor of a strong approach towards China, the president’s public posturing and messaging on the bilateral relationship would preclude any return to a sense of stability between Washington and Beijing.

Moreover, a Trump win could also see a return of the current divided government, which would similarly bode well for near-term defense spending. Based on the mid-term performance in 2018, a Trump presidency would almost certainly face a unified opposition Congress by 2023, with defense spending being one of many areas of conflict.

The other major factor analysts should pay attention to is how quickly the U.S. economy returns to “regular” economic growth rates of around 1 to 2 percent. The U.S. economy contracted by a record 32.9 percent annualized rate in the second quarter of 2020. It is possible that there will be rapid growth as lockdown ends and normal economic activity resumes. However, it’s unclear when pandemic-related restrictions will be lifted, or if businesses that have shut down will be able to re-start. In addition, the economic recovery may not be dramatic but may resemble something like the slow recovery that characterized the post-2008 economy. The virus’s increasing spread since the end of May as lockdowns ended will almost certainly cause additional economic damage and will force some cities and states to think twice before reopening too hastily. The more severe the recession, the more the government will likely need to take on debt, raising potential risks for defense spending.

Long-Term Considerations

In the long term, interest rates and relations with China will be the key variables driving U.S. defense spending. While the political configuration of the U.S. government will dictate the priorities of the administration, to a significant extent their behavior will be shaped by how they respond to changes in these two conditions.

Interest rates on federal debt were the driving factor behind the austerity budgets adopted by the Clinton administration in the early 1990s. Simply put, as interest rates rise the amount of money that the government must put towards servicing the national debt increases, and this can grow very rapidly (a 1 percent increase on servicing a debt of $25 trillion is $250 billion). While interest rates have remained exceedingly low since the 1990s, the slowdown in globalization and potential disruption of trade with China could have significant inflationary impacts, forcing the Federal Reserve to raise rates.

Over the past decade, despite a marked increase in the national debt relative to the size of the economy, borrowing costs have remained at or near zero. Should those rates rise, it is likely that Congress will need to take steps to reduce spending across the board. The defense budget, as the largest discretionary spending account, would almost certainly face real reductions or much more limited growth. At a minimum, higher interest rates will make it very difficult for defense spending to grow.

The second long-term factor likely to determine American defense spending is the United States’ relationship with China. The more contentious the relationship between the two nations and the more public the disputes become, the more support there will be for providing the Pentagon with the resources it believes it needs to defend U.S. interests. American public opinion has turned against Beijing during the pandemic. Republicans, much of the defense establishment, and many Democrats support a more assertive approach on China. However, there seems to be a wider array of opinions among Democrats. Nevertheless, both the Trump and Biden campaigns appear likely to position themselves as being hawkish on China, which will likely limit their flexibility on these issues after the election. Any military action by China, particularly against a U.S. ally, would almost certainly result in conflict and increased defense spending.

Other scenarios are worth considering. For example, what if the United States and much of the world remains focused on the pandemic and tensions between Beijing and Washington somehow manage to subside? Or what would happen if the economic impact of COVID-19 is even more severe than currently anticipated, and the global economy sinks in a prolonged depression? In these scenarios, defense spending might decrease in both real and nominal terms. The aftermath of COVID-19 could result in a prolonged downturn, reminiscent of the post-2008 recovery, setting the stage for a period of austerity at the federal level. Conversely, a future where a new Cold War with China looms and American defense spending grows further is also a distinct possibility. Until the direction of these factors is clear, defense analysts should be cautious and measured in their forecasts.

As in all things, time will eventually reveal the configuration of political power and the economic and strategic posture of the United States and its rivals. In the middle of a pandemic, the only thing that’s certain for the foreseeable future is uncertainty.

Matt Vallone is the Director of Research & Analysis at Avascent. He leads a team of defense and space-focused analysts in producing research products and data analysis. Prior to working at Avascent, he worked as the Legislative Director for Congresswoman Carol Shea-Porter in the House of Representatives.

Image: Department of Defense (Photo by Navy Petty Officer 1st Class Carlos M. Vazquez II)