One Size Fits None: The United States Needs a Grand Defense Industrial Strategy

The war in Ukraine has been simultaneously described as the first networked war and a “return of industrial warfare.” Lockheed Martin repurposed a diaper factory to make HIMARS launchers, the Ukrainian prime minister claims his country buys 60 percent of DJI’s Mavic drone production, and the conflict has introduced the term “FrankenSAM” for the cobbled together systems — like a Soviet-era Buk launcher firing Sea Sparrow missiles donated by NATO navies — defending Ukrainian air space.

While relying extensively on heavy artillery, tanks, advanced missiles, and millions of rounds of ammunition, Ukraine has also leveraged both cheap and advanced commercial technology to hold its own against its bigger and better equipped adversary. The scale and complexity of resourcing Ukraine’s requirements has challenged Western backers, and that was before the war in Gaza created further demand on U.S. munitions stocks. Future wars are likely to create still greater burdens.

So, how can the Pentagon ensure that it receives, at scale, the remarkable range of weaponry and military-related systems it needs now and in the future? The Department of Defense has promised to address this question with a new Defense Industrial Strategy to be delivered by the end of this year. The strategy will guide the Department of Defense’s policies, programs, and investments for at least the next three years and is “meant to catalyze a generational change” in how the Pentagon does business. But a real danger exists that this “first-ever” strategy document, like so many others generated by the U.S. government, will collapse into irrelevance under the weight of its many competing demands.

Ruthless prioritization, while essential for success, will be difficult to achieve given the complexity of the defense industrial base, limited resources, and the powerful stakeholders active on all sides. Most of all, prioritization will be complicated by the reality that there is no single set of policies that is right-sized to meet the needs of the sprawling and diverse set of companies, commodities, and technologies that fall under the “defense industrial base” umbrella.

Faced with this challenge and a finite budget to throw at it, the Department of Defense needs a grand industrial strategy that is “long-term in scope, related to the state’s highest priorities, and concerned with all spheres” of the base. Policymakers should acknowledge the finite means at the Department of Defense’s disposal, requiring hard choices about where and where not to invest. As the anchor for such a strategy, we recommend a reoriented approach that splits the defense industrial base into a few manageable “spheres,” identifies a small number of tailored industrial objectives for each, and suggests areas to delegate more to international and private sector partners. This approach would require a shift in the way defense policymakers think about the defense industrial base and their role in it, allowing more efficient use of resources while still meeting U.S. defense needs.

The Magnitude of the Problem

The challenges the Department of Defense faces in developing, acquiring, sustaining, and upgrading the advanced, high-profile platforms it is best known for are myriad and well-publicized. The backlog of Joint Strike Fighter (F-35) orders for both the United States and its allies is growing, even as sustaining existing planes looks near-impossible. Despite significant investment, American shipyards cannot produce enough submarines for the Navy, much less those promised to Australia via the trilateral AUKUS partnership with the United Kingdom. At the same time, the department is also struggling to deal with the large-scale acquisition of other traditional but long-neglected military commodities, such as the 155 mm artillery shell, in high demand in Ukraine.

However, the United States must now also address a range of non-traditional economic sectors that are central to generating modern military power, and the largely commercial, private sector actors that dominate these markets For example, by dominating satellite launches and unilaterally supplying Ukraine’s communications backbone, Elon Musk’s various private businesses make him a one-man Iron Triangle, enjoying a level of government influence that transcends anything assigned to the major defense contractors by their worst critics. At the other extreme, Ukraine’s organically developed synthesis of open source technologies and the combined human capital of thousands of citizens has vastly multiplied the combat power a relatively weak country can generate.

Addressing these different challenges requires the recognition that there is not one defense industrial base but several, each requiring a tailored approach to investment and management. This paper represents a preliminary effort to divide the defense industrial base into meaningful categories and identify a set of policy approaches for each that best advance U.S. national security objectives at a sustainable cost.

Defining the Ends

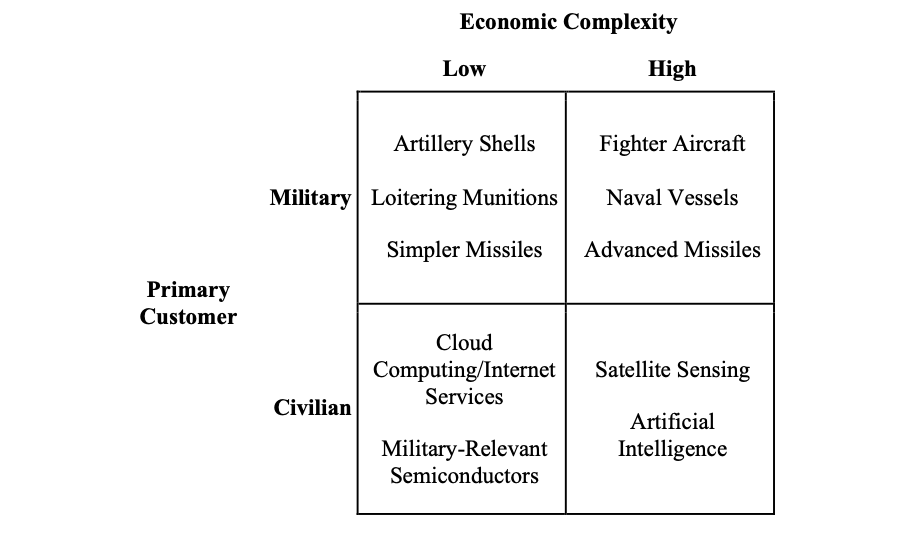

The defense industrial base varies along two key dimensions: the economic sophistication of the product being produced and the market’s relative balance between military and commercial demand. Economic sophistication distinguishes between advanced, high-cost, low-number systems and lower-cost, mass-produced items. Sophistication is not a proxy for the importance of a given product to military operations, but it does usefully define the market that provides these products and the type of investment required. The balance between military and commercial demand (and investment) points to sources of government leverage (or lack thereof). Where the military is the only buyer or one of a few, it can use its market power more directly to set requirements for how a product is designed and built, and sometimes even influence price. The same is not true in industries that cater to commercial clients where the military comprises only a small portion of demand.

These two dimensions produce the four-category framework shown in Figure 1. Thinking about the defense industrial base in this way has two advantages. First, it clearly separates sectors where government involvement is essential from those where the private sector should be in the lead, helping to focus and prioritize policymaker attention and resources. Second, it distinguishes between sectors where the United States has a strong comparative advantage and incentive to protect that advantage, and those areas where delegating to allies and partners can extend U.S. influence at lower cost.

Figure 1. Examples of Defense Products by Complexity and Customer

Economic Complexity

Business school professors and management consultants have long divided industries between commodities — natural resources, agriculture, simple manufactured goods — and differentiated products — advanced technology and manufactured outputs. As products become more complex, firms compete on quality and service rather than price alone, and markets tend toward concentration.

As others have noted, competitive advantage in contests with near peer adversaries like China may ultimately come down to which country has mastery of the most advanced technologies in areas such as semiconductors, biotechnology, space and satellite communication, and AI. As a result, the U.S. government will want and need to be centrally involved in investment, development, and acquisition of products with high economic complexity and technological sophistication. Elsewhere, however, it may make more sense to delegate to the private sector, foreign governments, or both.

The Department of Defense should similarly shape its procurement policies and prioritize its efforts according to the technological sophistication of the weapons and platforms themselves. Clearly, an F-35 Joint Strike Fighter differs in significant ways from 155 mm howitzer shells. Designing and procuring a sophisticated piece of hardware like the F-35 takes decades of research, development, and investment; the early groundwork for the jet was laid during the Clinton Administration, and constant upgrades are required to keep the system on the cutting edge to protect America’s competitive advantage.

While no less essential, commodity weapons are relatively simple in design and unsophisticated in technology. Low marginal costs make the price of producing one additional unit tiny. Beyond items like howitzer shells, even products within heterogenous categories such as anti-tank weapons can be substituted relatively easily. The Javelin has both long range (4,000 meters) and high cost ($175,000 per missile), while the NLAW provides an 800-meter range at $33,000 a pop. These both can be complemented if not displaced by Carl Gustav M4s ($500–$3,000 per round) and RPG-7s ($2,500).

As planners consider this spectrum, they must not fixate on the product category, as technical complexity can vary substantially within a class of weapons. A $32 million Reaper uncrewed aerial vehicle is one of the United States’ most technologically sophisticated systems, 50 percent more expensive than the crewed Super Tucano planes the United States provided the Afghan Air Force. Less-advanced Switchblade 300 loitering munitions can be mass produced quickly for $6,000 per unit, not much more than a “dumb” artillery shell.

Relative Civilian and Military Demand

Although F-35s and howitzer shells have no civilian use, the same cannot be said of other vital elements of modern military power. “Dual-use” technologies like semiconductors have long existed, and scholarship has recognized that the relative balance between civilian and military uses drives regulatory and arms control efforts, determining the appropriate level of government involvement.

Dual-use technologies are not new, but the ubiquity on the battlefield in Ukraine of commercially provided elements of what is commonly known as the “Fourth Industrial Revolution” appears qualitatively different to previous eras. Consider the various components in SpaceX’s “tech stack” of launch vehicles, satellites, and user terminals, which has proved remarkably resilient in the face of determined Russian countermeasures. Despite its extraordinary battlefield effectiveness, as Elon Musk lamented to his biographer: “Starlink was not meant to be involved in wars. It was so people can watch Netflix and chill.” And while Musk might now be making money from defense-specific applications, Starlink’s revenue largely rests on commercial customers.

In contrast, Ukraine exploits a more competitive commercial applications market on the ground to manage information for military purposes. Ukraine’s hundreds of mobile and Internet providers continue to make available a decentralized civilian network, through everything from stationary cellular towers to impromptu wireless hotspots, to provide a distinct military advantage.

Perhaps most intriguing among all commercial sectors being widely used in defense applications is AI, which has apparently been employed effectively in Ukraine to speed up target identification and weapon assignment. Eventually, AI may approach “general purpose technology” status, shaping the global economy across a wide range of sectors, improving productivity and creating new products and services. While it is too soon to determine if AI will be a commodity or a deeply concentrated market, it seems clear that commercial applications (and investment) will outstrip military ones.

Civilian and military markets interact in unusual ways and the balance changes over time. For example, over half (589 of 1,166) of satellites tracked by the Union of Concerned Scientists as “earth observation satellites” are described as commercial use. But their customers may still largely be governments. Maxar, one of the few publicly traded companies among major satellite providers, reports that 59 percent of its revenue comes from the U.S. government. Still, the Department of Defense’s $9 billion cloud computing contract is a rounding error for a market where Deloitte estimates $640 billion will be spent on “industry clouds.”

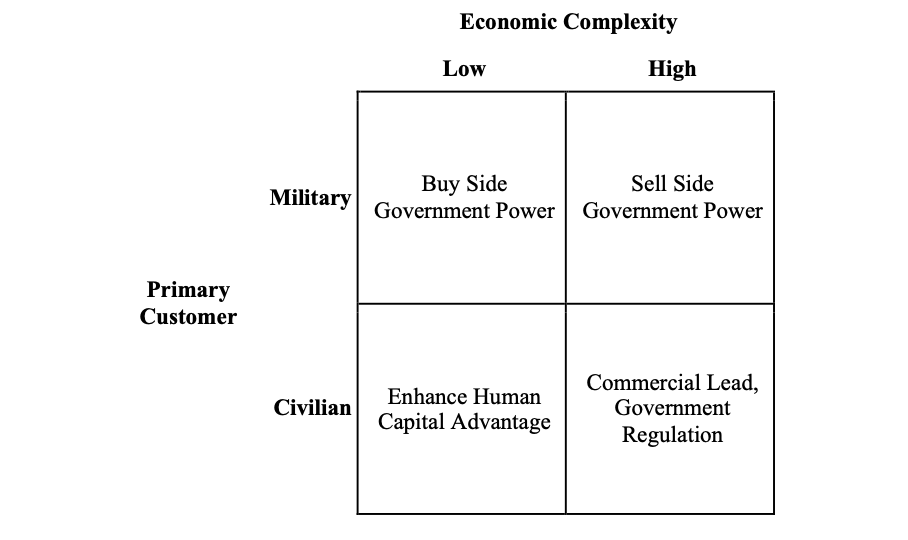

Defining the Means

These categories can help policymakers set priorities, identifying areas where they should be more and less involved and guiding their allocation of resources to sectors of highest need. For products almost exclusively used by the military, the U.S. government generally remains the major player, managing these sectors with the power of the purse, either as the predominant supplier or as a market-making buyer, depending on complexity. When Pentagon purchases are unlikely to put much of a dent in a firm’s business plans, the government should let the private sector lead while shaping incentives to ensure national security aims are met.

Advanced Military Capabilities: Fighters, Advanced Missiles, Submarines

In Ukraine and Gaza, much less the Indo-Pacific, these weapons remain a necessary component of wartime success. While the United States continues to extend its lead in this defense industrial segment, Chinese modernization, new European initiatives, and emerging players like South Korea are responding to rising demand. As noted above, the United States benefits from retaining an advantage over its adversaries in this area, requiring continued research and development and the production of next-generation technology. Even with scarce resources, this segment must remain the priority.

The United States can still profit from global supply and demand. Using the F-35 Joint Strike Fighter example, this can be achieved by extending the possibility of co-production to its friends and allies for at least some cutting-edge platforms. Arrangements like the AUKUS submarine consortium deliver several benefits, including developing economies-of-scale and cost efficiencies, and advancing the interoperability of military forces. The United States should use its market power to lead a cartel of like-minded platform manufacturers to provide allies with cutting-edge weapons, while jealously guarding the proliferation of such capabilities to potential opponents.

Military Commodities: Shells, Lower-End Drones, and Missiles

Since a large number of suppliers of relatively unsophisticated “commodity” items like artillery shells will emerge when demand is high, the United States should focus on purchasing, rather than producing, power. Rather than seeking autarky, it should seize the opportunities afforded by globalization to outsource production of these products. As witnessed in Ukraine, artillery shells and drones come from producers around the world, many of whom can make the product at lower cost than U.S. firms.

With a large, decentralized market of suppliers, the United States can ensure its access to these items at reasonable prices in the amounts it needs when it needs them, while preserving its defense industrial base capacity for areas where it has a true comparative advantage. The U.S defense base can still find ways to build better versions, but should not jealously guard their production. In this segment, the United States can leverage its ability as a massive buyer that can increase production relatively quickly when needed but is willing to outsource manufacturing to play a “market-maker” role. The Pentagon should encourage the commoditization of more weapons using its buying power to standardize product specifications and engaging in advance purchase agreements and other contracting devices. Even when demand inevitably falls, maintaining a global, latent ability to spin up production to wartime levels seems a plausible and cost-effective deterrent against territorial aggression.

Advanced Commercial Capabilities: Space

Perhaps the hardest acquisition challenges the Pentagon faces are those found in the quadrant where commercial markets dominate the demand for highly sophisticated technologies that are essential for military operations. Here, the U.S. government should support the ability of private suppliers to continue to innovate in ways that advance national competitiveness while protecting its own access to, and controlling the spread of, these capabilities.

Starlink is an obvious example, but consider also Palantir, which, according to its CEO, is “responsible for most of the targeting in Ukraine.” Palantir does a lot of business with the U.S. government, but its more commercial clients, ranging from Airbus to the World Food Program, appear to dominate its portfolio.

In this segment, the United States government should encourage competition, possibly by seeking out and encouraging private venture capital from investors willing to place bets in areas of high strategic importance to the Pentagon. Because venture capitalists are often hesitant to do business with the Pentagon due to its bureaucracy, the Department of Defense would need to make long-term financial or contractual commitments to new private sector start-ups to make these high-risk venture capital investments appealing. But some complex technologies with huge consumer demand will likely remain highly concentrated. In this case, the U.S. government must put into place a more robust regulatory regime that provides both incentives for innovation and potential penalties for non-compliance with national security requirements. The U.S. government’s use of Federal Communication Commission authority to tap the networks of telecommunications firms like AT&T and Verizon provides one precedent.

Commercial Commodities: Commercial Drones and Cloud Computing

Finally, when it comes to “commercial off-the-shelf” items like cheap drones or cloud computing, the Pentagon should accept that it will have little influence over shaping the market through economic power, though it might be able to partially shape the direction of innovation by creating incentives for private investment. Instead, it should focus on developing its human capital advantages to take these systems and mold their defense applications more effectively than rivals.

No Defense Industry Produces Silver Bullets

As it completes its first Defense Industrial Strategy, the Department of Defense should define an approach that allows it to navigate both the systems and commodities that have characterized warfare for decades and the new emerging technologies that will shape it for decades to come. Figure 2 suggests an industrial strategy appropriate for the four different market types we identify. To maintain the unique power of its defense industrial base in the face of a sharp fiscal constraint, the leadership in the Pentagon will have to make hard choices about where to prioritize and where to maintain flexibility. The key to finding this balance is recognizing the diversity of the supplier network and using market leverage and economic and technological complexity to guide allocation of attention and investment. The department should focus its energy and resources on products with high economic complexity; let partners take the lead in lower complexity goods; and employ market power, fiscal incentives, and regulatory tools to shape the incentives of key suppliers.

Like any strategy, our outlook identifies ideal types to guide policy. Many dual-use products are more evenly balanced across commercial and military customers, and thus will require a hybrid approach. More importantly, not only can a product like uncrewed systems straddle multiple categories, but a weapon’s qualities, and markets in general, are dynamic. As a product market’s qualities evolve so too must the strategy applied to it. Today’s exquisite product becomes tomorrow’s commodity; as Bruce Greenwald once observed: “In the long run everything becomes a toaster.” Products initially developed for military use can eventually produce enormous consumers markets. The commercial success of Silicon Valley was built on military defense industrial investments, but the most successful civilian commoditization in history, the standardized shipping container, did not achieve sufficient scale until the Vietnam War’s logistics demands. Most venture capital funds seek the outsized returns of civilian market success; innovative defense financing can convince these funds to take more of a risk when there is a potential military application as well. That said, we caution against industrial planning via military acquisitions; the United States government should focus on the defense industrial base.

This approach offers benefits to both the Department of Defense and the American public. For the Department of Defense, the primary benefits include more efficient allocation of resources; cost savings from better use of market leverage; and increased responsiveness to the materiel requirements of U.S. military forces and those of allies and partners through mechanisms like friend-shoring, increased competition in some parts of the defense industrial base, and infusions of venture capital where possible. The American public similarly benefits when the Pentagon has a more responsive and resilient approach to meeting defense needs, both in economic terms — from cost savings and new investment in innovation — and in security terms with a better prepared and equipped military force.

Jonathan D. Caverley is professor of strategy in the Strategic and Operational Research Department of the Naval War College’s Center for Naval Warfare Studies and a research affiliate in the security studies program at the Massachusetts Institute of Technology.

Ethan B. Kapstein is executive director of the Empirical Studies of Conflict Project, Princeton University.

Jennifer Kavanagh is a senior fellow in the American Statecraft Program at the Carnegie Endowment of International Peace.

Image: U.S. Air Force photo by Senior Airman Savannah L. Waters