COVID-19 and Economic Competition with China and Russia

The novel coronavirus pandemic has upended the global economy, reflected in dramatic declines in growth in national economies throughout the world, including those countries that the United States deems its leading global competitors: China and Russia.

The pandemic has resulted in amplified calls from U.S. policymakers to decouple economically from China, but doing so will be enormously expensive and is unlikely to occur on a large scale. Instead, the pandemic presents the opportunity to selectively decouple in the areas of highest priority to U.S. homeland and national security — communications and advanced technologies, especially those related to China’s military capabilities — and ideally, to do so in coordination with allies and partners. The pandemic is likely to further degrade Russia’s already damaged economy, but is unlikely to substantially change its international behavior or reduce any threat it presents.

The economic damage from COVID-19 has already been substantial. By April about half the world’s population and 90 countries were under some kind of mandatory or recommended confinement. In June, the IMF projected 2020 global economic growth of -4.9 percent.

And then second-quarter GDP growth results started rolling in. (Countries have different reporting conventions; for consistency, data in this paragraph and the next are for declines relative to the same quarter in the previous year). GDP fell by 9.5 percent in the United States, 14.4 percent in the European Union, and 21.7 percent in the United Kingdom.

Among the designated competitors, China’s decline occurred in the first quarter, a drop of 6.8 percent, with a rebound of 3.2 percent the second quarter. Second-quarter GDP in Russia dropped by 8.5 percent according to preliminary data.

One of the fundamental tenets of the National Security Strategy of 2017 and the National Defense Strategy of 2018 is that the United States is engaged not just in political and military competitions, but economic competitions as well. The documents hold that America’s leading competitors exercise malign influence in the economic domain. According to the National Defense Strategy, China is “using predatory economics to intimidate its neighbors,” and Russia “pursues veto power over the economic, diplomatic, and security decisions of its neighbors.” And underlying all of these competitions is a technology competition, since innovation and technology provide the basis for an advanced economy and powerful armed forces.

These current growth declines have the potential to reshape global strategic competition. Larger economies tend to trade and invest more than smaller economies, and thus have greater international connections. Furthermore, captured in the Meiji Japanese saying, “rich nation, strong army,” the size and sophistication of a nation’s economy is related to the effectiveness of its armed forces. Economic size increases a country’s ability to exercise leverage over other countries and set the rules of international competition.

But what might this new world of contagion, excess deaths, crashing economies, and lockdowns mean for the global economic competition? Cost considerations and the need to diversify supply have caused some companies to move parts of their supply chains out of China. These include companies such as Guangzhou Weihong Footwear Industrial Co., a supplier to Nike, Adidas, and Puma; Levi Strauss and Co., which is diversifying supply in some cases to save on labor costs and in others to manufacture closer to market and reduce shipping times; apparel maker TAL Group, supplier to such brands as Banana Republic and J. Crew; and electronics firms Panasonic, Foxconn, and Samsung.

But now a global push to use policy, rather than to rely on market developments, has emerged to reduce reliance on China, inspired in part by China’s provision of false information, its failure to even report the existence of the novel coronavirus appropriately, and its strong-arming other countries to silence criticism in exchange for economic benefits. However, although selective decoupling may take place, the effort to move production out of China will face strong headwinds. China is likely to remain central to the global economy over the next several years if not the next decade.

Russia, slammed by the disease, likely will remain financially stable because of its budget surplus, foreign reserves, and a large buildup in its National Wealth Fund. However, the economic shock could put many more millions into poverty and endanger Russia’s grand plan to reenergize growth and improve people’s welfare, the National Projects program. Even so, many of its foreign policy adventures are relatively low-cost, and so it is likely to maintain them.

China: Much Fury, But Any Action?

Discussions are occurring worldwide about reducing exposure to Chinese-centered supply chains and rethinking economic interactions with China, amplifying longer-standing concerns of supply-chain professionals. In the United States, some experts speculate that manufacturing in certain sectors, such as generic drugs, might return to the United States. U.S. political leaders want to learn more about the security of certain supply chains, such as pharmaceutical active ingredients, raw pharmaceutical components, and nonprescription drugs, and have discussed the importance of making certain products in the United States. More recently, President Donald Trump has proposed the idea of tax credits for companies that shift jobs from China to the United States.

Many of America’s treaty allies are having the same discussions. In Europe, locus of NATO, the European Union’s competition commissioner has said that member countries should take part ownership of European firms to prevent Chinese takeovers. Likewise, the European Union’s health commissioner intends to accelerate efforts to cut pharmaceutical dependence on China and India. The United Kingdom as of July 4 was on the verge of phasing out Huawei technology in its 5G network; France may also disallow Huawei participation; and politicians throughout Europe have reportedly revised downward their views of China’s reliability. These discussions about economics are complemented by worsening general views of China throughout Europe.

Among Asian treaty allies, Australia has started to consider ways to cut dependence on foreign countries, support local manufacturing, and reduce reliance on global supply chains. In Japan, the government set aside $2 billion to help companies move from China to Japan and $216 million to help them relocate to third countries. Although the amounts of money involved are small, this policy is one of the few concrete actions any country has taken to bring about movement of production out of China. In July, Japan announced the first round of implementation, with aid for 30 companies to move to Southeast Asia and 57 to move to Japan.

Among non-treaty security partners and potential partners, India amended foreign investment rules to require government permission for investments from countries that share a land border with India. This was likely aimed at China, spurred by the pandemic but reflecting longer-held unease. A deadly border skirmish in the Galwan Valley in June sparked further measures, including a requirement for online retailers to show country of origin, and restrictions on purchases from border countries for large public projects. India in August then decided to exclude Chinese telecommunications firms Huawei and ZTE from its 5G networks. And in Israel, which has strong economic and technology relationships with China, the coronavirus pandemic has renewed concerns about data-sharing and dependence on Chinese supply chains.

China also has faced rockier relations with the developing world because of the debt it is owed. Developing countries are now facing potentially severe pandemic-related economic difficulties. Multilateral organizations and major creditor nations all quickly agreed to debt relief. China — the largest bilateral creditor to developing countries and a member of some of these groups — was slow to commit to the debt relief that multilateral organizations and Western countries envision. Some African officials reported that China was demanding collateral, such as mining assets, in return for debt relief. Compounded by mistreatment of Africans in China, ill feeling toward China grew among Africans, building on earlier skepticism among some.

Finally, at the Forum on China-Africa Cooperation on June 17, President Xi Jinping committed to debt relief, agreeing to cancel interest-free loans. However, these loans constitute less than 5 percent of Africa’s debt to China, and although welcomed, the nature of relief for other debts is uncertain. In August, the G7 finance ministers called on all G20 countries to participate in that group’s debt relief effort, a message potentially aimed at China. At minimum, the transparency of China’s arrangements has been a concern, and the pressure on China may have become entangled in U.S.-Chinese rivalry.

African nations are not the only ones to exhibit growing unease regarding China. Beyond economics, and despite a messaging and propaganda effort to portray itself as a benefactor and the United States as a cause of the COVID-19 crisis, animosity against China has grown.

Australian Foreign Minister Marise Payne called for an international inquiry into China’s handling of the outbreak, and on April 21, 2020, Australian Prime Minister Scott Morrison made separate calls to Trump, French President Emmanuel Macron, and German Chancellor Angela Merkel to discuss the World Health Organization, improving the transparency and international responses to pandemics, and global cooperation toward recovery. Follow-up media reports said that Morrison was seeking support for an international investigation into the origins and spread of the coronavirus. China pushed back on the initial proposal, with Foreign Ministry spokesman Geng Shuang saying: “Australian Foreign Minister Payne’s remarks are not based on facts. China is seriously concerned about and firmly opposed to this.”

Global animosity has grown further due to China’s new Hong Kong security law. The United Kingdom has said that China has violated the Sino-British Joint Declaration underlying the handover of Hong Kong to China. Some observers have called this effectively the end of China’s promise of one country, two systems, with the United States deeming the effect “One Country, One System.” In response, the United Kingdom, Taiwan, Australia, the United States, Canada, and Japan have all raised the option of loosening restrictions on the ability of Hong Kong residents to emigrate. In addition, the United States, New Zealand, Germany, the United Kingdom, and Australia have all suspended their extradition agreements with Hong Kong, and France has halted ratification of its Hong Kong extradition treaty. On Aug. 19, the United States went further, cancelling three bilateral agreements, including one on reciprocal tax exemptions related to international ocean shipping.

There are therefore two large trends working against China. First is the potential for countries around the world to institute policy measures to try to achieve some degree of decoupling, which could harm China’s economy. Second is the potential that even if these policies cause economic pain in home economies, there may be political and public support for that tradeoff in the face of growing unease with China.

But will this actually happen? Unwinding from China will be difficult, and costly. Despite the push by Australia for an investigation into the origins of the coronavirus and despite worsening relations, China has remained Australia’s largest trading partner, receiving one-third of Australia’s exports, and government officials maintained that commercial relations remained good. Exports to China even hit a record in June 2020. Although China may try to develop other suppliers — for example for iron ore, Australia’s leading export to China — those suppliers will still have to compete with Australia’s quality, reliability, and efficiency.

In 2019, China was the European Union’s second-leading trade partner, accounting for almost 16 percent of the European Union’s combined imports and exports outside the customs union, behind only the United States, at 18 percent. The importance of China as a trade partner was even stronger for the European Union’s leading trader, Germany, for which China accounted for 18.6 percent of total trade, while the United States accounted for 20.1 percent. For the United States, those numbers are much lower: China accounted for 13.4 percent of total U.S. goods trade in 2019. Trade with the European Union (including the United Kingdom), Mexico, and Canada was larger, amounting to 20.5 percent, 14.9 percent, and 14.8 percent, respectively.

Beyond those numbers, the role played by Chinese businesses in global trade is important. China is a key part of global manufacturing supply chains, with components coming into China and then being transformed into finished products, or components being made in China and then exported for further production elsewhere, including in the United States.

In 2018, based on data derived from the World Bank’s World Development Indicators, China was the leading exporter of manufactured goods in the world, at $2.3 trillion, or 17.2 percent of global manufacturing exports. Number two Germany was far behind, at $1.3 trillion, or 9.9 percent of the global total. Number three the United States was responsible for about $1 trillion, or 7.3 percent of the global total. China’s dominance is likely even higher considering that tiny Hong Kong is the fifth-largest manufacturing exporter, at $550 billion, or 4.1 percent of the world total. Many of these goods are likely coming from China and being recorded as Hong Kong exports. Manufacturing exports from China and Hong Kong combined amount to almost $2.9 trillion, or 21.8 percent of the world total.

In the short term, China’s position looks even better. Alone among the major economies, it is starting to come back to life, having been hit earlier by the Wuhan-originating coronavirus. As a result, business opportunities for Western companies are expanding in China and can offer a modest lifeline as they struggle to sell to Western markets. Despite much talk of decoupling and some exits, China remains a strong location for business.

Even with European anger, it is not apparent that Europe will actually take any serious action that could set back its relations with China. Facing pushback from China over an April 2020 draft report on disinformation and the coronavirus pandemic, the European Union apparently softened a report that in its original form had been described as “not particularly strident.”

This is not the only time Europe has pulled back from a confrontational stance regarding China. In March 2019, a joint communication from the European Commission and the European High Representative for Foreign Affairs and Security Policy declared China a “systemic rival” in some cases. But European leaders never formally endorsed that language, and even in summer 2020, European leaders seem more interested in placating and partnering with China.

The situation is similar in the developing world. There may be anger, and the anger may be justified, but China still offers below-market financing; goods, and particularly information and communication technology goods, that are lower priced than those offered by developing countries and are perfectly adequate for the customer; and efficient construction of much-needed infrastructure. Furthermore, 53 largely developing countries backed a joint statement to the U.N. Human Rights Council supporting China’s Hong Kong security law, with only 27 mostly advanced, democratic countries backing a competing statement opposing the law.

There is one more economic issue that suggests little change: Under Xi Jinping, China has been trying to reduce its own reliance on the rest of the world. So while some Western policymakers would like to see greater decoupling, that goal is in line with China’s own policy. And like the West, China is not finding it easy at all.

Russia: Further Decline

Even before the coronavirus, Russia was in economic trouble. Following the collapse of oil prices in 2014 and U.S. and European sanctions instituted that same year after Russia annexed Crimea and intervened militarily in eastern Ukraine, Russian growth has slowed dramatically. gross domestic product grew an average annual 2.6 percent from 2010 to 2014, but only 0.5 percent from 2014 to 2018. A lack of structural reform, leaving the Russian economy reliant on oil and gas exports, compounded those problems. Over the longer term, Russia also faces demographic challenges — although these may not affect its ability to project power, at least in the near term — as does much of Europe.

It was Russia’s bad luck that just as the coronavirus hit, Russia and Saudi Arabia failed to reach agreement regarding oil production and pricing, and global oil prices collapsed. Kremlin aims in refusing to agree to sustain higher prices appear to have included a desire to force higher-cost U.S. shale producers out of the market. But the tactic boomeranged as Saudi Arabia turned on the taps and drove prices even lower. The Kremlin then retreated and agreed to a new deal with Saudi Arabia brokered by Trump.

From an average daily price of $63.65 per barrel in January 2020, the price of global benchmark Brent crude fell to $18.38 in April before rebounding to $40.20 in June. Oil and gas exports constituted 55 percent of all Russian exports from 2016 to 2018. Before the COVID-19 crisis that figure was projected to remain about the same through 2020. Oil and gas revenue constituted 40 percent of Russian federal budget revenues from 2016 to 2019, although the total indirect oil and gas contribution was likely higher because of taxes collected on economic activity generated by oil and gas revenues, such as taxes on imports paid for with oil and gas revenues. The new Trump-brokered agreement to limit oil production has not affected oil’s biggest challenge: lack of global demand.

Demographically, Russia has been in steady decline, with exceptions in only a few years. Population has fallen from 148.8 million in 1995 to an estimated 141.7 million in 2020, down 4.7 percent. The working-age population — ages 15 to 64 — has declined from 102.9 million in 2002 to an estimated 95.3 million in 2020, down 7.4 percent. Both figures are expected to continue downward, with working-age population falling more rapidly.

The novel coronavirus likely will have at least three notable economic effects on Russia.

First, there have been direct economic effects. Russia’s shutdown began on March 30, when it suspended all nonessential work in Moscow and Moscow Oblast (region or province) and encouraged the regions to follow suit. With the energy price crash, the shutdowns have contributed to an economic disaster. Beyond the second-quarter GDP decline of 8.5 percent, a full-year decline of 4.5 percent to 5.5 percent is expected. Russia has instituted a fiscal relief plan valued at 3.4 percent of GDP, with a recent tranche announced in June. But much of this relief does not involve new injections of money into the economy, instead lowering expenses through tax holidays or making borrowing easier through loan guarantees. Once such non-cash measures are removed, the injection of new money could be much lower. Furthermore, despite initial fears of inflation from a depreciation of the ruble caused by steep oil price declines through April, Russia now faces the threat of disinflation from reduced domestic and external demand. In response, the central bank in June cut its interest rate to 4.5 percent, the lowest since the fall of the Soviet Union, followed by another cut in July, to 4.25 percent.

Second, reduced global demand for energy will decrease export and government revenues, even with the rebound in oil prices. The International Energy Agency projected in April that global energy demand for 2020 would fall by 6 percent, the largest proportional decline in 70 years and the largest absolute decline ever.

Third, Russia faces a slowdown in its large-scale investment plans. In late 2018, President Vladimir Putin announced a $417 billion National Projects program to boost investment, economic performance, and population well-being. This amounted to about 25 percent of that year’s GDP, and 134 percent of that year’s federal budget expenditures. More recently, with declines in living standards hurting his approval ratings as he prepared for the successful late June constitutional referendum on reforms to extend his rule, he announced $60 billion in infrastructure and social spending, 3.5 percent of 2019 GDP and 19 percent of 2019 federal budget revenues.

In a demonstration both of how important these National Projects are to the Kremlin and how off-track they might have gotten, in January Dmitry Medvedev may have been ousted as prime minister in part for not getting them underway. His replacement, Mikhail Mishustin, is a strong administrator. But in the face of the economic downturn, Russia announced in May that it would adjust spending on the National Projects, with presidential spokesman Dmitry Peskov saying any potential adjustments would not affect implementation. Then, in July, Russia announced a major adjustment, instead saying it would lay out a national development plan for 2030.

Under a variety of scenarios, even the best case for Russia is economic damage. However, it is unlikely to experience a financial or economic crisis. Russia has been assiduous at running a budget surplus, building up its National Wealth Fund ($174 billion in July 2020), and building up foreign reserves ($592 billion at the end of July 2020). These amount, respectively, to 10.1 percent and 33.3 percent of 2019’s $1.7 trillion GDP. Likewise, they amount to 55.1 percent and 181.5 percent, respectively, of 2019 federal budget revenues of almost $312 billion. Russia’s public foreign debt is only 3.1 percent of GDP, and its total foreign debt is 29.4 percent of GDP. It has planned its budget to balance at an oil price of $42 per barrel, giving it an ability to withstand long-term low oil prices that many oil producers do not have.

All of this suggests the economy may continue at its muddling pace with a further decline in living standards. But the Kremlin is facing painful tradeoffs. On the one hand, declines in living standards could spur unrest, as occurred in summer 2018 after the authorities announced a plan to raise pension eligibility ages. On the other hand, depleting reserves could make Russia more vulnerable to such pressures as tighter limits on Western credit or investment. The 2014 sanctions shock led the Kremlin to shift to a policy of building up reserves at the expense of economic growth and living standards. To date, the Kremlin has chosen to maintain its financial buffers, although this could change.

Implications for U.S. Policy and Economic Competition

The United States may have a window of opportunity to press allies and partners to reduce their economic connections with China and even to gain their willing cooperation in the effort. This will be complicated by current U.S. trade actions that include elevated steel and aluminum tariffs on allies and the threat to impose auto tariffs on them. Because decoupling from China will be costly, goals should be chosen carefully and focus on defense and security. Communications and data networks are important both to the economy and U.S. homeland and national security, and advanced technology plays a foundational role in U.S. economic prosperity, defense capabilities, and the development of China’s military capabilities. Accordingly, priorities for moving supply chains out of China include components in communications and data networks and goods and equipment that can enhance China’s advanced technology capabilities, focusing on those related to its military power.

Even if decoupling stalls, the United States needs to ensure that there is a diverse supply of components, including inputs to components down the supply chain, especially for defense items. Pushed by nationalism at home, China is likely to retain its foreign policy assertiveness, characterized by so-called wolf warrior diplomacy, reflecting growing nationalist sentiment. It is important to avoid having supply either dominated by China or resting with one supplier in a country that might withhold supplies in the future. Diversifying supply chains would benefit from coordination with allied nations, given the combined economic strength of the United States and its allies. Stockpiles of resources critical to the economy and U.S. defense can also be built up. Diversifying supply could be costly, and it would pose a dilemma over whether to allocate those costs to the defense budget (thereby reducing the total amount that can be purchased) or to the private sector (thereby reducing U.S. companies’ ability to compete globally). However, remaining reliant on producers in China might be more costly should a contingency arise.

There are few new actions the United States should take regarding Russia, except to stay on guard and continue to press it to reverse its aggressive policies. It is true that if government budget revenues decline, Russian defense spending may decline. Just as in the United States, Russian defense spending, particularly on expensive modernization, may need to decline to fit the Russian economic picture. Production runs for some new weapons could be smaller.

However, Russia’s foreign military interventions are likely to continue. These interventions tend to be low cost and high priority for the Kremlin’s foreign policy, although popular support for the wars in eastern Ukraine and Syria has declined. Likewise, information operations and interference in U.S. and other foreign elections are low-cost and likely to continue. Following the disputed elections in Belarus in early August and subsequent violence, concerns about Russian intervention have emerged. Accordingly, Russia will remain a security challenge. Moscow is taking risks with its harassment of U.S. warships or aircraft. If incidents were to cause U.S. casualties, Congress could respond with more sanctions.

Finally, there are implications for both Russia and China together, with Russia continuing or even quickening its turn toward China. Accelerated by the 2014 sanctions, the two countries have drawn closer and upgraded their relations to a “comprehensive strategic partnership for a new era.” Tangible aspects include the new Power of Siberia gas pipeline and plans to vastly increase Russia’s energy export capacity to China. As long as Russia remains at odds with the West, a longer and steeper Russian downturn could create greater incentives for Russia to draw closer to China as a market and source of investment. Furthermore, either Russia’s own policy of increasing isolation from the West, or an increase in the benefits it reaps from working with China, could disincentivize Russia from resolving its disagreements with the West to get sanctions lifted. That, in turn, may hamper Russia’s ability to get much-needed Western investment and technology, potentially further stunting its growth over the long term — but not reducing it as a near-term challenge.

Howard J. Shatz is a senior economist at the nonprofit, nonpartisan RAND Corporation and a professor at the Pardee RAND Graduate School.

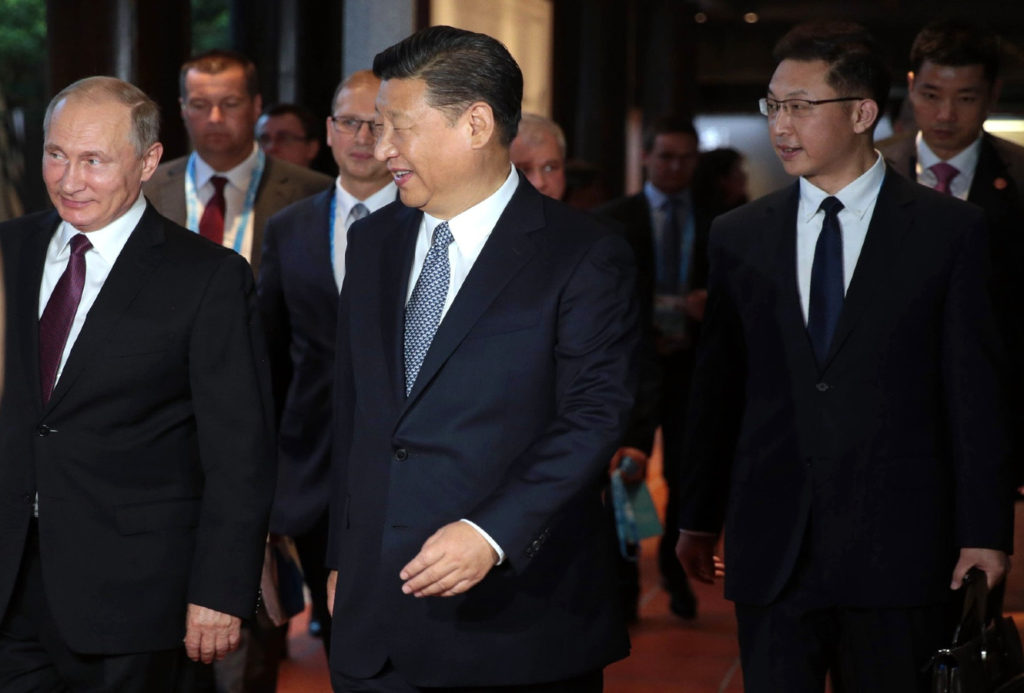

Image: kremlin.ru