Join War on the Rocks and gain access to content trusted by policymakers, military leaders, and strategic thinkers worldwide.

The Pentagon’s arsenal and defense industrial base is built on materials that China can turn off like a light switch. Growing uncertainty in critical mineral markets and the open weaponization of supply chains by China has prompted a paradigm shift in how the Pentagon addresses these issues.

In July 2025, the Department of Defense and MP Materials structured a package comprising equity in the company, a 10-year price floor for certain rare earth elements, long-term magnet offtake, and project financing. This represents a major departure from previous investments to support the defense industrial base. It also appears successful in attracting sizable private capital.

But exposure remains acute because China dominates many device-grade processes and has layered export license controls on almost a dozen critical materials since August 2023. Although a new trade framework resumed shipments for rare-earth magnets, licensing discretion remains in China’s hands.

Washington should act now.

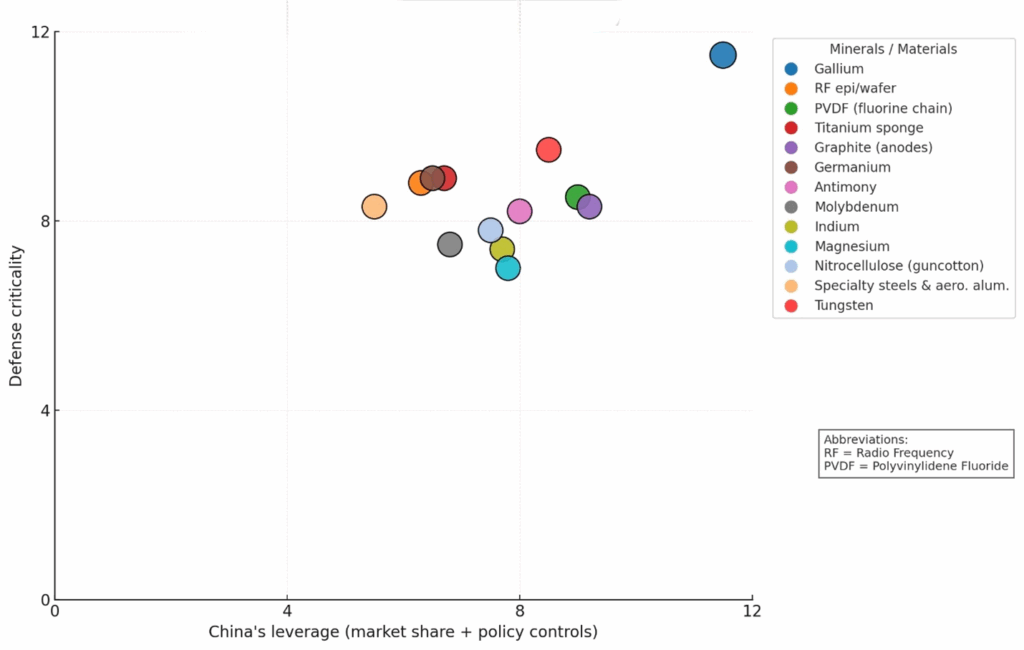

Unlike earlier arguments that emphasize building bigger government stockpiles, or broad calls to overhaul the defense industrial base, we focus on short-term chokepoints within military supply chains and whether they might be amenable to a multi-pronged approach analogous to that used for rare earths and magnets. We identify seven such candidates through our unique matrix that identifies critical materials for U.S. defense that China has the most leverage over. Targeted, fit-for-purpose interventions, in mineral and material markets, such as price floors, long-term offtakes, concessional loans, and allied partnerships can be replicated across these nodes to de-risk supply chains within two to four years.

A Practical Test for Material Chokepoints

Not every “critical” material is an urgent problem. A material chokepoint exists when five conditions coincide: high concentration in mining or refining, direct defense criticality, low substitutability without performance loss, long, capital-intensive build times, and recent signs of policy leverage such as export licenses, price manipulation, quotas, or prohibitions.

How vital is each material to U.S. defense, and how much leverage does China wield?

First-tier risks are gallium, the battery-chemicals chain, tungsten, and graphite. A second tier includes titanium sponge, germanium, antimony, indium, magnesium, and molybdenum, with nitrocellulose and finish-line capacity in specialty steels and aerospace aluminum requiring near-term hedges because surge capacity is slow to add.

Crucially, most chokepoints rarely happen at the actual mine. Most problems occur in mid- and downstream steps such as refining, separation, smelting, high-purity processing, alloying, component manufacture, and device-grade finishing. Ore alone does not deliver security. Rather, mid- and downstream control does.

Two pathways close gaps. First, build at home where chemistry, processing and finishing are the binding constraints rather than geology. This includes materials such as lithium-ion battery chemistry, coated and synthetic graphite anodes, nitrocellulose for propellants, semiconductor wafer and epitaxy capacity, infrared-optics finishing cells, tungsten-carbide recycling, and the finishing lines for specialty steels and aerospace aluminum. These are proven processes that can be similarly secured with the MP Materials deal toolkit, which included price floors, long-term purchases, concessional loans, equity, and paid surge capacity. Expanding these capabilities at home reduces exposure to Chinese leverage, grows the U.S. industrial base, and ensures that the finishing steps most critical to defense remain under American control.

Second, hedge upstream exposures with allies where ore, smelting, or primary refining are concentrated abroad. Examples include structured offtake and investment into Ukraine’s titanium chain; stabilizing non-Chinese antimony roasting in Oman and Europe while U.S. recycling ramps; and interim tolling with Japan and Europe for gallium, germanium, and indium until U.S. lines qualify.

For each material, align remedy to the chokepoint: If it is chemistry or device-grade finishing, build U.S. lines with price floors and multiyear offtake. If it is about upstream and feed gaps, use allied offtake and tolling as U.S. finishing ramps. When policy leverage appears, apply the playbook.

Where to Act First: Seven Priority Chokepoints

There are seven areas where short-term risk to military supply chains is greatest and government funding and support is needed to fill gaps in the finance stack . The framework presented here attempts to summarize a strategy of when to build domestically or buy internationally, given permitting priority and some revenue certainty (i.e., price floors and offtake).

Gallium, Germanium, and Indium (Advanced Electronics and Infrared Optics)

Gallium and germanium underpin advanced radar, secure communications, and infrared optics, while indium (byproduct of zinc refining) is essential for optoelectronics and specialized coatings.

The main chokepoint is not mining but refining and device-grade processing, which China dominates. The fix is to build U.S. wafer and infrared-finishing capacity by guaranteed purchases and surge clauses through the Chips and Science Act and the Defense Production Act, expand recycling to cut raw dependence, and partner with Japan and Europe until U.S. tools are ready. Price floors are needed to make by-product projects viable. New epitaxy tools take 18 to 30 months to qualify, while infrared optics can be sped up with polishing cells and local vendors. Ongoing expansions in Florida and Arizona could deliver results in under two years.

Graphite Anodes and the Fluorine Chain (Battery Bottlenecks)

Most defense systems, from radios to drones, run on lithium-ion batteries built on supply chains China controls. The choke point is midstream refining and processing. The Defense Department should fund U.S. capacity with price floors and guaranteed offtakes, co-finance graphite anode plants, and stockpile high-purity salts and binders. Near term, it can source natural graphite from friendly countries like Canada and Mozambique. A North American battery line could pair with polymer capacity in Louisiana, Georgia, and Kentucky, while hedging with Japanese and European supply during ramp-up. First commercial volumes could arrive 18 to 36 months after investment. Domestic anode plants in Louisiana, Alabama, and Tennessee show the way, with brownfields taking 12 to 36 months and mine-to-anode chains 24 to 48 months.

Titanium Sponge (Aerospace at Risk)

Titanium sponge is a critical feedstock for aerospace-grade titanium. With no domestic titanium sponge production, U.S. defense supply chains rely on imports from Japan, Saudi Arabia, Kazakhstan, and now Ukraine. Although titanium ore is abundant across the West and sub-Saharan Africa, the bottleneck lies in producing aerospace-grade sponge at scale (metallurgy and economics). Short-term hedging means establishing a small strategic sponge reserve and allied tolling while assessing a domestic restart. Medium-term resilience will require structured offtakes and equity in allied projects.

Thus, insure offtakes of ore (slag) or sponge from Japan and Ukraine, anchor them to the U.S.-Ukrainian minerals pact, back Velta’s build, and scale and qualify U.S. primary-metal and melt (forge) capacity, taking around 24 to 48 months to reduce Chinese dependency.

Tungsten (a Heavy Metal with No Substitute)

Tungsten’s density and temperature performance make it unmatched for penetrators, turbine alloys, and cutting tools. China’s dominance, combined with artisanal and complex concentrate chains in tin, tantalum and tungsten, requires the United States to secure non-Chinese ammonium paratungstate offtakes, robust recycling, and allied tolling with Japan, South Korea, and Europe. It also means building domestic tool-fabrication and powder capabilities. Plan on about 18 to 30 months to lock recycling contracts, longer if new mine feed is needed.

Antimony (a Small Element with Outsized Strategic Value)

Antimony is essential for primers, propellants, solders, and night-vision glass. Current supply depends on U.S. and European recyclers and fragile domestic producers. Perpetua’s Stibnite mine in Idaho has Defense Production Act Title II support, but mine output will take time to reach scale and quality. To secure supply, the Pentagon should lock in multi-year recycler offtakes, support one or two allied roasting centers through joint ventures, expand recycling and waste-to-value efforts, and tap refractory-gold calcines until Idaho mining ramps up.

Nitrocellulose (the Forgotten “Guncotton” Propellant)

Without nitrocellulose, it becomes impossible to surge ammunition production in a crisis. The bottleneck is chemical and solvent-recovery capacity heightened by Chinese control. To solve, add domestic lines, modernize recovery and drying, dual-source linters, and keep production plants whole with throughput contracts across the cycle.

Specialty Steels and Aerospace Aluminum (the Finish-Line Constraints)

U.S. defense programs do not lack steel or aluminum; they lack finishing capacity in specialized mills that certify the exact forms required for strong ships, aircraft, and armored vehicles. This includes advanced refining, thick-plate rolling, quench (age), large presses, and advanced labs, at speed.

Although companies are building capacity (Carpenter intends to add a melt and forge capacity; Novelis is building a recycling and rolling plant; and Constellium Muscle Shoals has a Defense Department-backed casting expansion), the main choke point is finishing capacity. Thus, fund surge slots with price floors and offtakes, speed cross-qualification, and bridge with Canadian and European plate (extrusion), anticipating 18–36 months to qualify rolling and melting assets.

The Art of Replication

The Pentagon-MP Materials deal is not a novelty. It represents a financing model that filled an identified gap on time. Its scale, and ability to attract large investors like Goldman Sachs, JP Morgan, and offtakes from Apple proved these projects could be made attractive to private investors. While not without risks, similar bespoke approaches can strengthen other vulnerable nodes in the defense industrial base, from electronics materials and battery chemistry to structural inputs, energetics, and finishing.

The Pentagon is stockpiling cobalt and a new report underscores antimony, titanium, and tungsten as critical for defense while warning that warns that magnesium and tantalum are increasingly vulnerable to China’s export controls.

Success should be measured by capacity coming online within two to four years, reduced exposure to Chinese leverage, more days of supply, and faster restart potential. The principles are clear: Prioritize domestic chemistry and finishing first, rely on allies for interim feed and tolling, and build a shock-resilient industrial base that can sustain performance under duress.

Replicating the rare earths and magnet model across seven priority materials is the difference between resilience and vulnerability in the next conflict. If Washington acts, chokepoints can be closed. If it waits, the next war may see American production lines idled not by enemy strikes, but by Chinese chokeholds on minerals.

Macdonald Amoah is a communications associate at the Payne Institute for Public Policy, where he assists with research on critical minerals and issues within the general mining space.

Morgan D. Bazilian, PhD, is the director of the Payne Institute for Public Policy and professor at the Colorado School of Mines. Previously, he was a Fulbright Fellow and lead energy specialist at the World Bank and has over two decades of experience in energy security, natural resources, national security, energy poverty, and international affairs.

Clarkson Kamurai is a critical minerals program manager and research associate at the Payne Institute for Public Policy. A mining engineer with over 18 years of experience, he is currently in the Mineral and Energy PhD program at the Colorado School of Mines’ Economics and Business Division

Jahara “FRANKY” Matisek, PhD, (@JaharaMatisek) is a U.S. Air Force command pilot and nonresident research fellow at the U.S. Naval War College, Payne Institute for Public Policy, Resilience Initiative Center, and Defense Analyses and Research Corporation. He has published over one hundred articles on national security and foreign policy.

The views expressed are those of the authors and do not reflect the official position of the U.S. Naval War College, U.S. Air Force, or Department of Defense.

Image: Holly H. Jordan via DVIDS.