The Chip Wars of the 21st Century

Controlling advanced chip manufacturing in the 21st century may well prove to be like controlling the oil supply in the 20th. The country that controls this manufacturing can throttle the military and economic power of others. The United States recently did this to China by limiting Huawei’s ability to outsource its in-house chip designs for manufacture by Taiwan Semiconductor Manufacturing Company (TSMC), a Taiwanese chip foundry. China may respond and escalate via one of its many agile strategic options short of war, perhaps succeeding in coercing the foundry to stop making chips for American companies. If negotiations fail, China might take drastic measures, turning the tables on the United States. On the more modest end of the spectrum, China might start some type of trade war with Taiwan to ensure access, following the playbook Beijing used to coerce Korea over Terminal High Altitude Area Defense (THAAD) or Australia over its recent decision to lead a call for investigating the origins of the novel coronavirus. On the more extreme end, these Taiwanese chip foundries might be subject to an aggressive campaign of sabotage. And even though observers of the region might downplay the risk, it is not impossible that this could be used as a part of a casus belli for China’s long-held desire to reunify by force. Such is the importance of chips in this era.

Either way, Washington should be worried. If the United States were to be deprived of access to these foundries, the U.S. defense and consumer electronics industries would be set back for at least five years. Moreover, because China is investing in its own chip foundries, it could become the world leader in technology for the next decade or more. That’s why it was encouraging to see Republicans and Democrats in the House and Senate propose $25 billion to help America’s semiconductor industry. But this should only be the start.

There are two types of semiconductor manufacturing companies in the chip industry. Some (like Intel, Samsung, SK Hynix, and Micron) design and make their own products in factories that they own. There are also foundries, which fabricate chips designed by consumer and military customers; TSMC is the largest of these in the world. The chips that TSMC makes are found in almost everything: smartphones, high-performance computing platforms, PCs, tablets, servers, base stations, game consoles, internet-connected devices like smart wearables, digital consumer electronics, cars, and almost every weapon system built in the 21st century. About 60 percent of the chips TSMC makes are for American companies.

In 2012, a bipartisan committee of the U.S. House of Representatives investigated whether the Chinese company Huawei had put backdoors into its equipment that enabled it to spy on data therein. The committee found that Huawei could not or would not explain its relationship with the Chinese government and did not comply with U.S. laws, but it did not reach a conclusion as to whether such backdoors exist. Still, most observers agree that the company is not careful with security. The report recommended that no government or contractor systems include Huawei systems. In 2019, the U.S. Department of Commerce’s Bureau of Industry and Security added Huawei to its Entity List, effectively limiting the sale or transfer of American technology to the company, though a series of licenses have been granted to waive the restrictions in some cases.

This month, the Commerce Department required overseas semiconductor firms that use American technology and equipment to apply for a license before selling to Huawei. The order was targeted at TSMC, which is Huawei’s main supplier of advanced chips; without these, Huawei will be at a competitive disadvantage against Apple or Samsung in the smartphone industry, and against Cisco and others in the market for network equipment. (Some analysts have pointed out the order has potential loopholes.) Next up, it’s likely Washington will prohibit sales to China of the equipment used to make chips, which comes from companies like Applied Materials, KLA Corporation, and Lam.

TSMC Chose America’s Side, For Now

In May 2020, TSMC announced it was going to build a $12 billion foundry in Arizona to make some of its most advanced chips. Foundries take at least three years to build and are the most expensive factories on earth. Construction on TSMC’s facility is planned to start in 2021, but actual chip production will not start until 2024.

While the announcement is welcomed, if and when the Arizona foundry is built it will only be able to process about a quarter of the chip productions of TSMC’s largest semiconductor fabrication plants and would amount to just 3 percent of the manufacturing capability that TSMC currently operates in Taiwan. There they have four major manufacturing sites, each of which have six or seven foundries producing 13 million wafers — thin slices of semiconductors — a year. Compare that to the quarter of a million wafers they intend to process in the United States in 2024. If the United States lost TSMC to China, one new American plant would not make up the difference in capacity.

China’s Semiconductor Industry

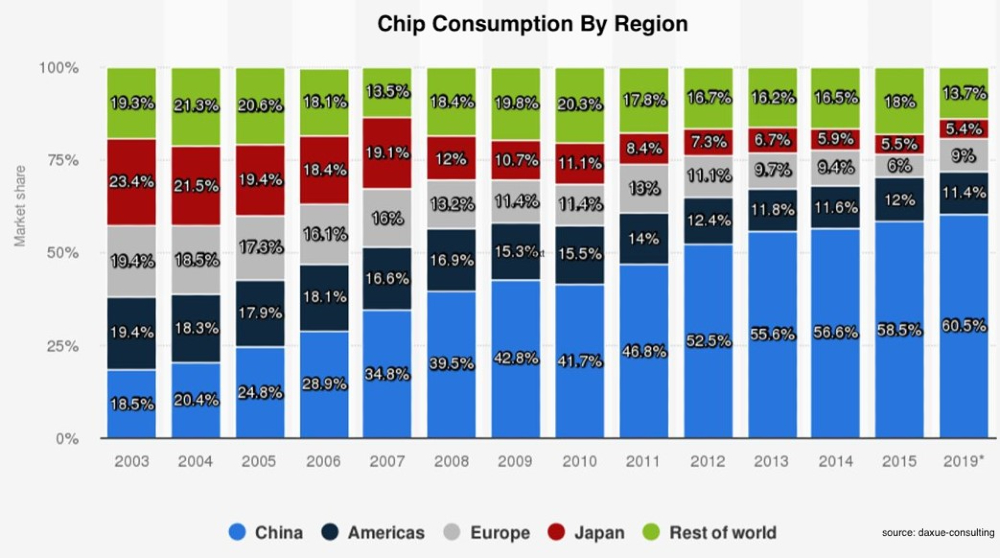

A decade ago, China recognized that its initial success as the world’s low-cost factory was going to run its course. As the cost of Chinese labor increased, other countries like Vietnam could fill that role. As a result, China needed to build more advanced and sophisticated products on par with the United States. However, most of these products required custom chips — and China lacked the domestic manufacturing capability to make them. China uses 61 percent of the world’s chips in products for both its domestic and export markets, importing around $310 billion worth in 2018. China recognized that its inability to manufacture the most advanced chips was a strategic Achilles heel.

China devised two plans to solve these problems. The first, the Made in China 2025 plan, was the country’s roadmap and financing vehicle to update China’s manufacturing base from making low-tech products to rapidly developing ten high-tech industries, including electric cars, next-generation computing, telecommunications, robotics, artificial intelligence, and advanced chips. The goal is to reduce China’s dependence on foreign technology and promote Chinese high-tech companies globally. In addition, to encourage Chinese high-tech companies to go public in China rather than in the United States, the Chinese government set up its own version of the Nasdaq called the STAR market (Shanghai Stock Exchange Science and Technology Innovation Board).

China’s second plan is the National Integrated Circuit Plan, a roadmap for building an indigenous semiconductor industry and accelerating chip manufacturing. The goal is to meet its local chip demand by 2030.

Make no mistake: These are not the kind of government announcements that don’t end up going anywhere. This is a massive national effort. China is spending over a hundred billion dollars to become a world leader in developing their semiconductor industry. The China Integrated Circuit Industry Investment Fund, or “Big Fund,” raised $51 billion — $22 billion in 2014 and another $29 billion in 2019. China has used the capital to start over 70 projects in the semiconductor industry (such as building foundries, acquiring foreign companies, and starting joint ventures) and has gone from making zero to 16 percent of the world’s chips, though today their quality is low. Going forward, China plans to start investing in chip design software, advanced materials, and semiconductor manufacturing equipment.

China’s leaders believe that this is their century and see American actions as designed to hold China back from its proper place in the world. Given the importance of controlling the supply of advanced chip manufacturing, China would be forced to respond if the United States cut off their access to this supply. The question is whether China will view the action against Huawei as sanctions against a single company, or as a portent of further action against China’s access to advanced chips.

What Has China Learned from America’s Prior Actions?

In the 21st century, the United States has blinked when its own interests were at stake. From the perspective of some Chinese policymakers, America is exhausted from endless wars in Iraq and Afghanistan and unlikely to fight again. They see that the United States is divided politically, distracted by the COVID-19 pandemic, and unlikely to risk American lives for something as abstract as a chip factory.

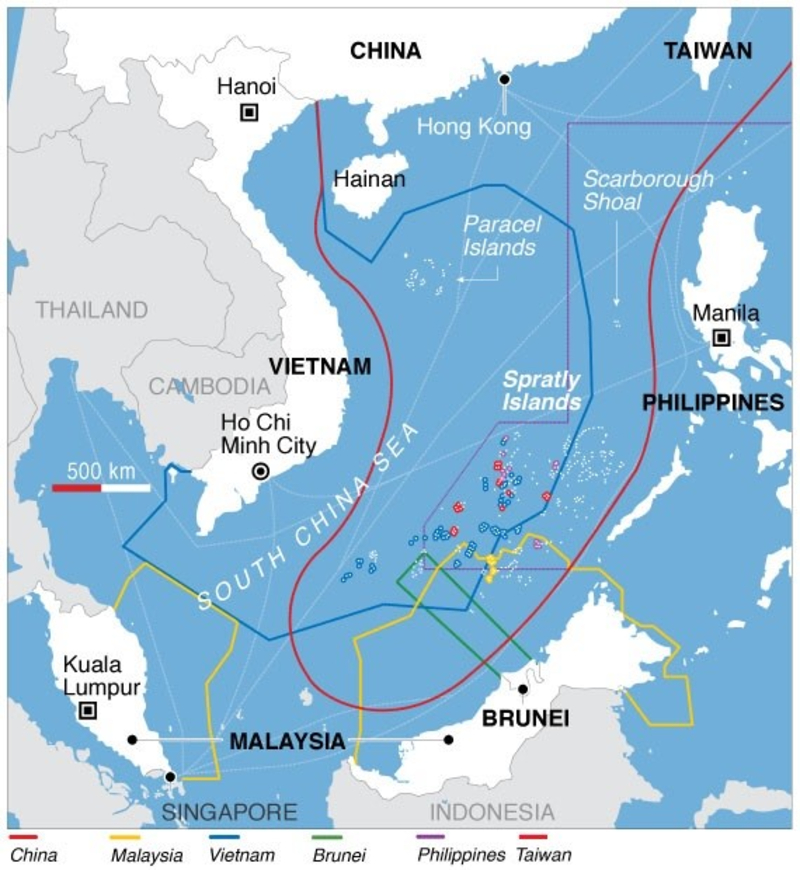

When China has acted aggressively over the past couple of decades, it has seen that the American response has largely been paper protests. In 2012, China occupied the Scarborough Shoal and took control of it from the Philippines. As China was not ready to militarily confront the United States at the time, what if the Americans had parked a carrier strike group near those shoals? Could that have prevented China’s plans for military construction in the area? Instead, Washington blinked and limited itself to strong words. Today, the nearby Spratly Islands have new Chinese bases bristling with surface to air missiles and fighter jets, which has changed the calculus for a war in the western Pacific. Any attempt by the United States at controlling the air space in the area will face serious opposition and heavy losses.

Up until recently, Hong Kong, while part of China, had guarantees of freedom of speech, assembly, and the press. China is preparing to impose the same draconian limits on speech, assembly, and the press that muzzle the rest of China. There is not much the United States can do other than express concerns and perhaps remove the city’s special trade status. But China doesn’t care. It has already factored the American response into this move and decided it was worth it, with the cynical calculation that any response would make Hong Kong poorer, and that any business the city loses will mostly end up in other parts of China — or that business lost to other countries is the cost of asserting control over Hong Kong, and one it can bear. And a poorer Hong Kong will be punishment to its citizens for standing up for the rights that they had been promised.

The day after China moved on Hong Kong, Chinese Premier Li Keqiang left out the word “peaceful” in referring to Beijing’s desire to “reunify” with Taiwan, an apparent policy change.

The lack of an effective American response to these events has shown Chinese leadership that the United States is unwilling to forcefully engage in Asian affairs. This will embolden China’s next move.

China’s Goals and Options

China’s goal in the immediate term is to secure a steady supply of chips. To respond to the United States cutting off Huawei’s access to Taiwan’s most advanced chip foundries, the Chinese Communist Party is likely thinking through its next moves. China may wish to avoid any escalation by talking to the United States and either accepting the restrictions as they currently are, with a promise that they will go no further, or negotiating to restore Huawei’s access to TSMC by accepting other restrictions elsewhere. Alternatively, Beijing may seek to negotiate with or coerce Taipei (or both) in order to allow China sole access to TSMC and block chip exports to the United States, thereby securing China’s own supply while crippling American industry. Or China might kick over the table entirely by working to ensure that TSMC foundries cannot be used by either Huawei or the United States through some sort of concerted sabotage campaign, or even a direct attack. While these more aggressive scenarios might seem implausible, China’s behavior has become more aggressive and more risk-tolerant as the COVID-19 pandemic, which began in Wuhan, roils the world.

A return to the status quo, with a restoration of Huawei’s access to TSMC’s foundry, may simply require negotiating some form of trade deal or agreeing to restrictions on the sale of Huawei networking gear (34 percent of its revenue). If achievable, this kind of deal would let the Huawei consumer and enterprise businesses (66 percent of its revenue) survive and thrive. However, it requires the Chinese to back down. And China may have decided that the Rubicon has been crossed.

If China does not negotiate, the danger is that the United States ups the ante further by prohibiting TSMC from working with more Chinese firms or bans the sale of the equipment used to build chips to any company in China. Such escalation may lead China to perceive that U.S. actions are not a dispute about Huawei, but in fact a salvo in a wider economic war. The Chinese Communist Party would then need to work out how to force TSMC to do its bidding.

The least likely option is to carry out the threat that the Chinese government has made since 1949: There is only one China, Taiwan is a rebellious province, and China will reunify by force if necessary. This option has the highest risk of provoking an American military response, and while possible, it is extremely unlikely. China can achieve its immediate goals and weaken Taiwan without an outright invasion or blockade.

The second and perhaps more likely path is a trade war combined with a major disinformation campaign against TSMC and the United States that would make current influence campaigns emanating from China pale in comparison. This would emphasize that the United States is the aggressor and is illegally waging economic war against China. Beijing could announce that since Taiwan is a province of China, China has the right to restrict TSMC sales to the United States and enforce an embargo of any chip sales to American-affiliated companies. This could be coupled with an equally massive disinformation campaign to the Taiwanese people, pointing out that the United States won’t go to war over a semiconductor company, and that China’s requests are fair and reasonable. How effective a disinformation campaign would be is up for debate, given that Chinese campaigns in Taiwan’s January elections did not result in the election of China’s preferred candidate. China could offer a no-invasion pledge in exchange, while reminding the Taiwanese government of what they already know: Regardless of promises, the United States can’t defend them. Even if the United States attempted to intervene, there is a serious debate unfolding about how useful legacy American platforms – especially carriers – would be in a shooting war with China.

There is a high probability that Taiwan will still refuse despite all of this, so China would then ratchet up the pressure. First, it could nationalize TSMC’s two less-advanced foundries in mainland China. Next, China could launch a precision-guided missile strike against one of the older TSMC foundries in Taiwan to send a message. China could announce it will destroy one foundry each week until TSMC agrees to sell only to China. Even destroying all the TSMC foundries in Taiwan would still be net win for China: American military and consumer technology would no longer have advanced foundries, but China would.

What Should the United States Do?

Would the United States go to war with China over chips? The loss of TSMC would leave the United States scrambling to find alternate sources. America could turn to Intel to restart its foundry business or to Samsung or even Global Foundries. But the transition and recovery would take at least three years, if not more, and tens of billions of dollars. In the meantime, the United States would have second-tier status in technology.

The outcome could depend on the timing of Chinese actions: The current U.S. administration may not want to start a war before the presidential election, but it is unpredictable enough that a campaign season focused on China could change the calculus. If the presidency changes hands, the incoming administration may de-escalate and reverse the original restrictions, but a lot can happen between now and January 2021.

The dispute over Huawei’s access to TSMC has highlighted how vulnerable American industry is to the loss of its sole supply of advanced chips. If the matter cannot be solved by negotiation, China may perceive the restrictions as economic warfare and rapidly escalate, potentially threatening Taiwan. It is not at all clear that Washington has thought through the consequences of its actions here, nor that the current administration has considered chip supply as part of a wider supply chain security and national industrial policy. Given that China has more positive options than the United States, it is surely time for those in charge to consider where this might lead.

Entrepreneur-turned-educator Steve Blank is credited with launching the Lean Startup movement. He’s changed how startups are built; how entrepreneurship is taught; how science is commercialized; and how companies and the government innovate. Steve is the author of The Four Steps to the Epiphany and The Startup Owner’s Manual. His May 2013 Harvard Business Review cover story defined the Lean Startup movement. He teaches at Stanford and Columbia, where he is a Senior Fellow for Entrepreneurship; and created the National Science Foundation Innovation Corps — now the standard for science commercialization in the United States. His national Hacking for Defense class is revolutionizing how the U.S. defense and intelligence community can deploy innovation with speed and urgency.